It was a similar story for both Costco and Broadcom on Thursday. Both companies beat earnings expectations, but saw their share prices dip slightly. That said, investors have to be happy with the fact Costco is up about 52% year to date, and Broadcom was up about 66% at Thursday’s close (with an after-hours gain of 10% at press time).

Costco highlighted gold (yes, Costco sells gold bars), home furnishings, sporting goods and hardware as key areas of growth. E-commerce sales were up 13% year over year.

Broadcom was focused on its custom AI chip development. That’s probably a good place to zero in on, seeing as how AI revenue is up 220% year over year! Broadcom CEO Hock Tan said, “We see an opportunity over the next three years in AI. Massive specific hyperscalers have begun their respective journeys to develop their own custom AI accelerators.”

To compare U.S. tech companies (like Oracle) to Canadian counterparts, check out my article on the best tech stocks in Canada at MillionDollarJourney.com.

The best online brokers, ranked and compared

The U.S. economy is not the U.S. Stock Market

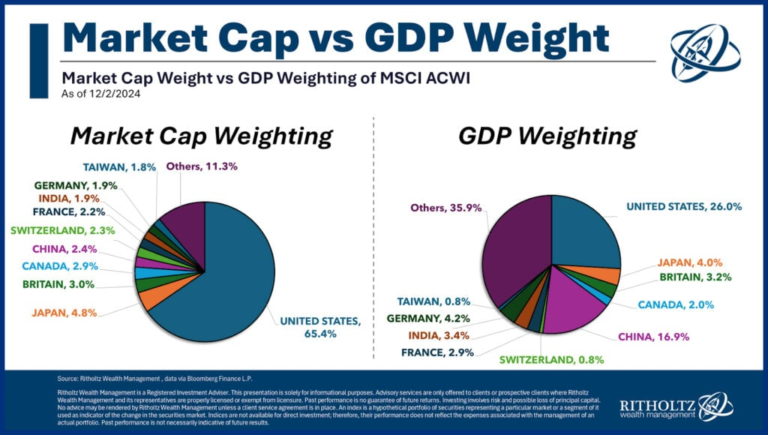

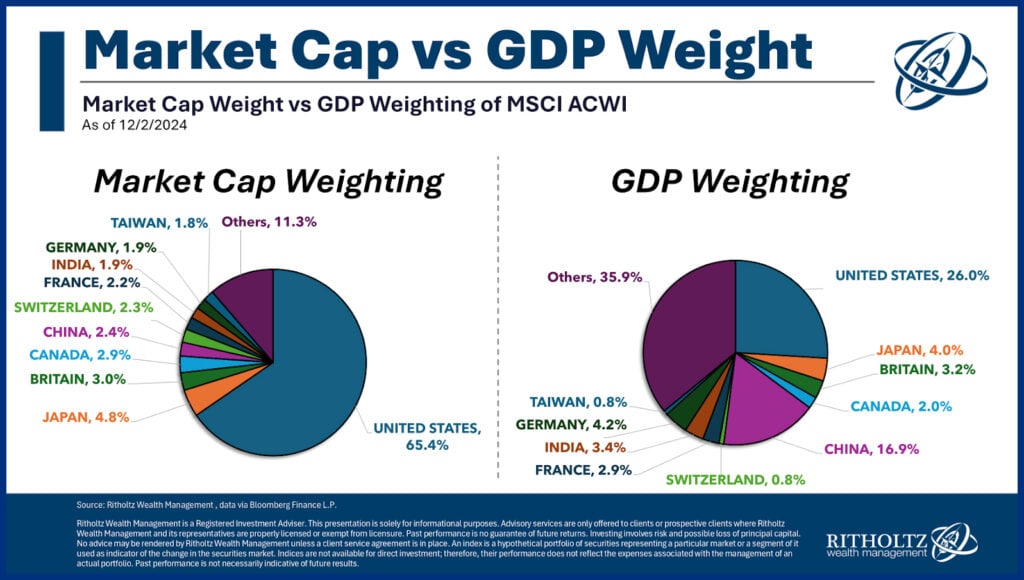

It’s logical, at first glance, to think a country’s worth of its largest companies (measured by the market capitalization of its stock markets) might be directly tied to its economic performance (measured by GDP).

But remember, the stock market is not the economy! The U.S. has a massive economy, but it has a substantially larger share of the world’s investment dollars.

A country’s largest companies can sell products and services outside their nation’s borders. At the moment, investors are willing to pay way more for the same profits from an American corporation than corporations in most other places in the world. That’s due to many factors. But foremost among them is the view that American companies are an excellent long-term bet for increasing profits relative to companies headquartered elsewhere.

It’s interesting that investors appear to be quite confident in America’s ability to keep making money, despite widespread concern about America’s decline and speculation that the U.S. dollar is going to be in trouble any day now.